A Franklin congregation loves its 19th-century home. Insurance woes could spell its decline.

| Published: 04-10-2025 4:03 PM |

Stephanie Van Horn loves the flower cutouts in the old wooden archways inside the Franklin Unitarian Universalist Congregation parish hall.

The hall is a grand space for a small congregation hovering around 25 people these days. Red velvet cushions contrast with dark wood pews and light filters through the lattice frames of stained glass panels.

For nearly five decades, parishioners have scattered throughout the main hall on Sundays. Regulars file into their usual pews with knitting projects in hand. In that atmosphere, Van Horn feels right at home.

But 21st-century concerns loom over the congregation, with the cost of insurance coverage skyrocketing and putting the building’s future in jeopardy. Increases for old structures have become a common problem in a strained insurance market, according to the state’s Department of Insurance.

For long-time churchgoers like Louise Proctor, these rising costs put pressure on the congregation to consider a hard decision.

“We could sell this and build something smaller that would be appropriate for our congregation,” said Proctor. “But we decided that there are so many memories here.”

For Proctor, the church on Central Street in downtown Franklin was a space where her young children could learn about different religions.

A rotation of ministers leads the weekly service. More often than not, a member of the congregation steps up to try their hand at it, too.

Article continues after...

Yesterday's Most Read Articles

‘New Hampshire is just going to embarrass itself’: Former Child Advocate warns against proposed office cuts

‘New Hampshire is just going to embarrass itself’: Former Child Advocate warns against proposed office cuts

Two of five Grappone auto franchises to be sold as part of family transition

Two of five Grappone auto franchises to be sold as part of family transition

‘Erosion of civil public discourse’ – Concord mayor makes plea for more civility

‘Erosion of civil public discourse’ – Concord mayor makes plea for more civility

GOP lawmaker wasn’t fired over transgender bathroom comments, business owner says

GOP lawmaker wasn’t fired over transgender bathroom comments, business owner says

‘A large chunk of change’: Feathered Friend Brewing disputes tariff on Canadian import

‘A large chunk of change’: Feathered Friend Brewing disputes tariff on Canadian import

‘It's like slow genocide’: Crowd rallies against proposed Medicaid cuts

‘It's like slow genocide’: Crowd rallies against proposed Medicaid cuts

For years, the church was covered by Church Mutual Insurance, a specialized provider that insures churches and nonprofits. Earlier this fall, the Unitarian congregation received a letter stating that the church’s annual policy would not be renewed unless it completed a series of repairs to the building within 60 days.

To Proctor, this deadline felt like an impossible and expensive race against the clock.

Before a commercial insurance policy is renewed, the provider does an on-site inspection of the building. The review found that the building’s roof was in poor condition, flood damage lingered in the basement and the building did not have a lightning rod, which is required for older structures.

“They have to do it at least 60 days before your renewal,” said Proctor. “Then you don’t have the time to actually do whatever work they want you to complete.”

The Franklin congregation was able to stave off the renewal for one more year because the insurance company missed a notification deadline. But the ordeal prompted Proctor and others to wonder about whether they were the latest victims of a national problem.

The short answer is yes, according to New Hampshire Insurance Commissioner D.J. Bettencourt.

Nationwide, demand for insurance coverage has risen in the wake of natural disasters, such as floods in North Carolina and wildfires in California, according to Bettencourt. Inflation, interest rates and supply chain issues are driving up costs, too.

As a result, insurance providers are more risk-averse, he said. Older, historic buildings, like a church from the 1800s, pose a greater challenge.

“Companies are scrutinizing that now a lot more carefully,” Bettencourt said. “They want to manage their risk exposure.”

Providers can’t drop existing customers on a moment’s notice, though. State law mandates that the renewal process follow set deadlines that offer a time period for the insurance customer to make repairs. The state insurance department can also serve as an intermediary resource to help decipher deadlines and decisions.

The Franklin non-renewal notice felt particularly confusing to long-time member Paul Duncanson. The year before, Duncanson made a plea to the congregation asking the group to spend $250,000 on building repairs.

They spent some money to repair the roof, with Ducanson spearheading the bulk of this work himself. With a team, he also addressed basement damage from a prior flood and installed new stainless steel pipes throughout the building.

When they shared these improvements with their insurance provider, the company said it still did not want to renew the coverage.

“Whatever we do it’s not enough,” said Van Horn.

As the congregation shopped for a different policy, new rates were through the roof. Instead of $6,000 per year, new rates started at $16,000.

“Now we’re kind of like, are we going to make it next time around?” said Proctor.

While the congregation population has dwindled in recent years, the building is home to more than the small but faithful group.

Twice a week, the church houses Breads and Roses, a local soup kitchen. The space is also used for Franklin’s Women, Infants and Children Nutrition Program and Narcotics Anonymous meetings.

To Van Horn, it’s a community staple she wants to hold on to. A few years ago, she moved down to Concord. Each week, she makes the 30-minute drive back to Franklin to come to church.

Being at the whim of an insurance company – knowing the building is fine one year but at risk the next – feels like a losing battle they can’t control.

Even with six months’ notice, lining up contractors, scheduling repairs and getting the approval of other congregation members to spend money is an arduous process.

Van Horn also knows they’re not the only congregation lucky enough to gather in a 19th-century structure where the ceilings are high and floorboards are worn.

With that, she wonders what their solution is.

“We’ve been trying to find out if other churches are in the same predicament,” she said.

The consumer services unit of New Hampshire’s Department of Insurance can help both residential and commercial properties shop for plans, decipher renewal notices and answer questions.

Call the Consumer Services unit at 603-271-2261, in state toll free (800) 852-3416 or email consumerservices@ins.nh.gov.

Michaela Towfighi can be reached at mtowfighi@cmonitor.com

Baseball: Slow night at the plate costs Concord in loss to Windham, 3-1

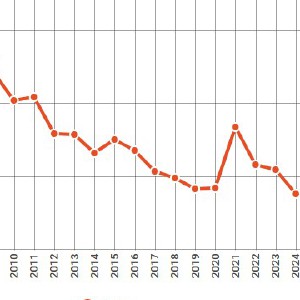

Baseball: Slow night at the plate costs Concord in loss to Windham, 3-1 New Hampshire births fell to a modern low in 2024

New Hampshire births fell to a modern low in 2024