Prosecutors: Andy Sanborn used pandemic relief funds to pay lakefront property mortgage

Concord Casino owner and former state Sen. Andy Sanborn was arrested Tuesday and charged with theft by deception in connecting with pandemic aid paid to small businesses in 2020. (New Hampshire Attorney General’s Office)

|

Published: 10-17-2024 5:37 PM

Modified: 10-17-2024 5:46 PM |

Felony charges filed against Andy Sandborn accused him of using a portion of pandemic relief aid to pay off a private mortgage on a lakefront property in Laconia owned by his wife, Laurie Sanborn, a seven-term State representative.

Prosecutors say Sanborn inflated revenue figures at both his Concord Casino and the Draft sports bar, his landmark location to secure $286,682 through the Main Street Relief Fund, a program aimed at helping small businesses during the pandemic.

Three months after receiving the funds, Sanborn transferred $177,000 to his private account to pay off the mortgage of a seasonal three-bedroom property overlooking Lake Winnipesaukee bought by Laurie Sanborn in 2015, according to court documents.

In addition to the state relief funds, Sanborn also received Paycheck Protection Program (PPP) loans, which were later forgiven.

Court documents reveal that Sanborn, referring to himself as “State Senator” five years after his term expired, contacted the Department of Revenue Administration to complain about having to repay a portion of the state funds.

He also asked his accountant David Penchansky for advice on repaying the loan.

“We are concerned we have to pay all the money back (our revenue was not down 25%) yet we spent the money like we should have (keeping our employees on payroll, rent, etc during the shutdown) but now the state is saying we need to pay all the money back by April 15th,” wrote Sanborn to Penchansky in 2021. “We don’t have the money.”

These communications were received as part of a search warrant approved in February by Judge John Kissinger authorizing the seizure of records from Penchansky & Co. PLLC, the accounting firm Sanborn had used since 2007.

Article continues after...

Yesterday's Most Read Articles

“If we made less in 2020, is the amount we have to pay prorated in some way or do we pay none of it back?” asked Laurie Sanborn in an email to their accountant about repaying the state funds in 2021.

Sanborn’s company, WIN WIN WIN LLC, which operates Concord Casino and The Draft on South Main Street, reported in its grant application that the businesses brought in $3,169,209 in gross receipts for 2019. In reality, their combined gross receipts for that year totaled just $2,071,328, according to court documents.

This misrepresentation allowed Sanborn to receive additional money than his businesses were eligible to receive through the Main Street Relief Fund. If the true revenue had been reported, he would have been entitled to just $98,208.

But, the Sanborns didn’t stop at merely inflating their revenue figures, investigator Allison Vachon wrote in the probable cause statement for Sanborn’s arrest. They also misrepresented key operational details to secure the state funds and federal tax returns.

The Main Street Relief Fund was designed to assist businesses with gross receipts of less than $20 million, provided they had been operational for at least a year before May 29, 2020. However, Sanborn’s casino missed that requirement.

In an email exchange between Sanborn and his tax accountant, Sanborn noted, “On the Casino, it was only open for 6 months in 2019 and 12 in 2020 (and it was up on revenue anyway).”

Concord Casino according to New Hampshire Lottery Commission was operational only from June 2019.

This investigation began as a result of a compliance audit of Concord Casino by the Lottery Commission in the fall of 2022.

As part of the investigation, bank accounts for the Sanborns’ businesses and personal accounts were subpoenaed.

After the state funds were credited to their bank account for WIN WIN WIN LLC, $92,000 was withdrawn and credited into the account for The Draft.

Sanborn has been released on bail and he will be arraigned at the Merrimack Superior Court in November.

From raising chickens to programming a VR game, Merrimack Valley High School students show off their senior projects

From raising chickens to programming a VR game, Merrimack Valley High School students show off their senior projects Baseball: Slow night at the plate costs Concord in loss to Windham, 3-1

Baseball: Slow night at the plate costs Concord in loss to Windham, 3-1 ‘It's like slow genocide’: Crowd rallies against proposed Medicaid cuts

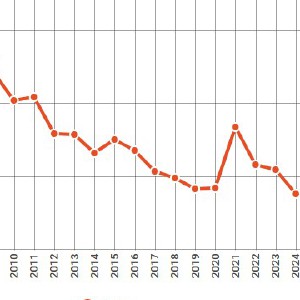

‘It's like slow genocide’: Crowd rallies against proposed Medicaid cuts New Hampshire births fell to a modern low in 2024

New Hampshire births fell to a modern low in 2024